How Much Is Home Exemption In Hawaii . If a husband and wife live apart and own separate homes, each shall. No (second home or investment property). Property taxes on assessed value up to. the law allows just one (1) home exemption; to assist oahu property owners seeking information on home exemptions and other common tax relief programs. • the basic home exemption for homeowners 60 to 64 years of age is $85,000. home exemption claimed: bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 65 to 69.

from www.templateroller.com

If a husband and wife live apart and own separate homes, each shall. • the basic home exemption for homeowners 65 to 69. home exemption claimed: to assist oahu property owners seeking information on home exemptions and other common tax relief programs. Property taxes on assessed value up to. • the basic home exemption for homeowners 60 to 64 years of age is $85,000. the law allows just one (1) home exemption; No (second home or investment property). bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the.

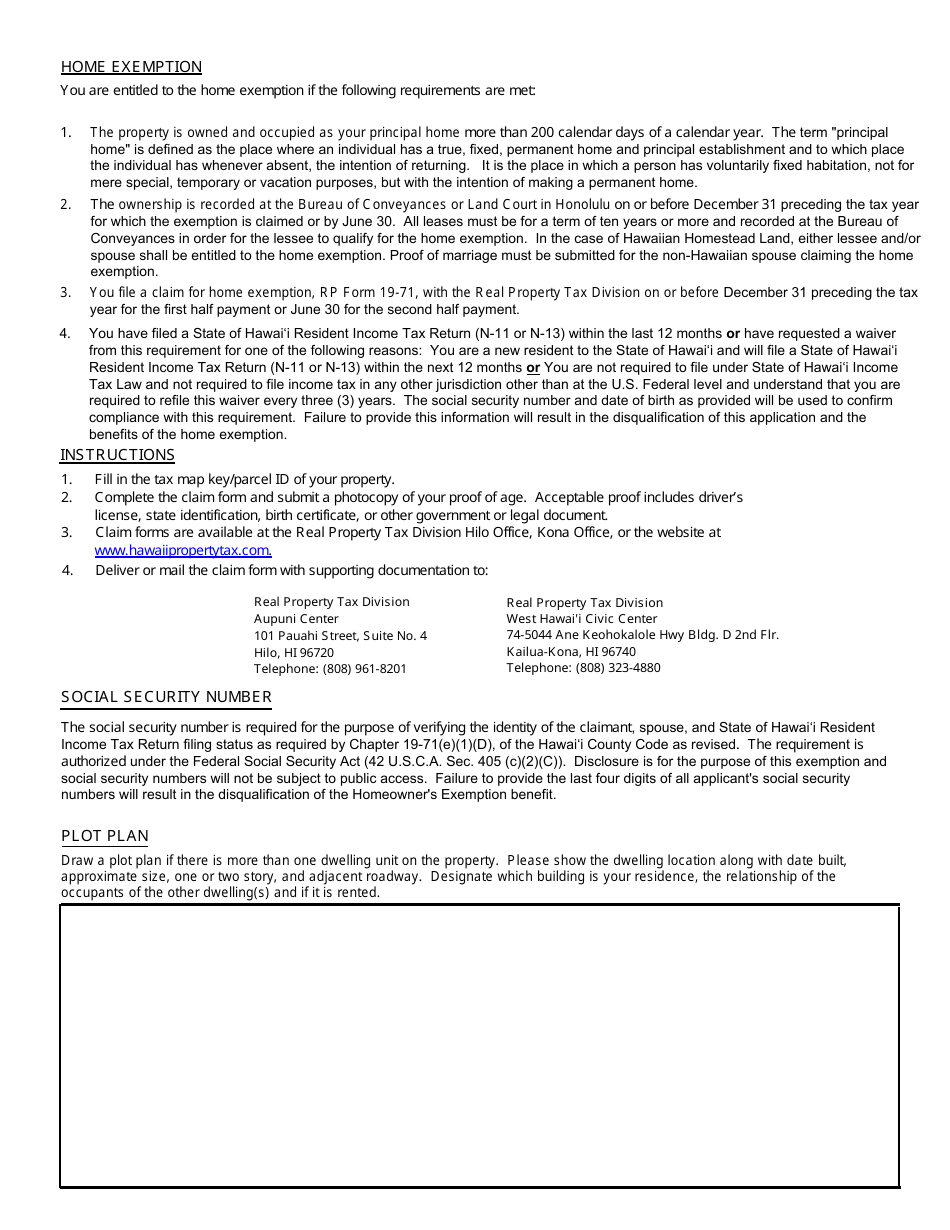

Form RP1971 Fill Out, Sign Online and Download Fillable PDF, County

How Much Is Home Exemption In Hawaii If a husband and wife live apart and own separate homes, each shall. No (second home or investment property). bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 60 to 64 years of age is $85,000. Property taxes on assessed value up to. If a husband and wife live apart and own separate homes, each shall. the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. home exemption claimed: to assist oahu property owners seeking information on home exemptions and other common tax relief programs.

From www.hawaiiliving.com

Claim Your Honolulu Home Exemption & Save Big Oahu Real Estate Blog How Much Is Home Exemption In Hawaii • the basic home exemption for homeowners 60 to 64 years of age is $85,000. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. to assist oahu property owners seeking information on home exemptions and other common tax relief programs. the. How Much Is Home Exemption In Hawaii.

From www.pdffiller.com

2011 HI RP Form 1971 Hawaii County Fill Online, Printable, Fillable How Much Is Home Exemption In Hawaii home exemption claimed: to assist oahu property owners seeking information on home exemptions and other common tax relief programs. the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000. How Much Is Home Exemption In Hawaii.

From www.hawaiiliving.com

New Hawaii Property Tax Rates 2017 2018 Oahu Real Estate Blog How Much Is Home Exemption In Hawaii • the basic home exemption for homeowners 60 to 64 years of age is $85,000. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 65 to 69. Property taxes on assessed value up to. home. How Much Is Home Exemption In Hawaii.

From www.hawaiilife.com

Maui's New LongTerm Rental Exemption Hawaii Real Estate Market How Much Is Home Exemption In Hawaii • the basic home exemption for homeowners 65 to 69. the law allows just one (1) home exemption; bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. Property taxes on assessed value up to. home exemption claimed: • the basic home. How Much Is Home Exemption In Hawaii.

From dxoahfegw.blob.core.windows.net

Texas State Housing Exemption Form at Robert Marmol blog How Much Is Home Exemption In Hawaii to assist oahu property owners seeking information on home exemptions and other common tax relief programs. the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. If a husband and wife live apart and own separate homes, each shall. No (second home or investment property). Property taxes on assessed value. How Much Is Home Exemption In Hawaii.

From hometaxshield.com

Understanding the Texas Homestead Exemption How Much Is Home Exemption In Hawaii bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 60 to 64 years of age is $85,000. No (second home or investment property). If a husband and wife live apart and own separate homes, each shall.. How Much Is Home Exemption In Hawaii.

From www.signnow.com

Good Reason for Geographic Exception 20082024 Form Fill Out and Sign How Much Is Home Exemption In Hawaii Property taxes on assessed value up to. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. home exemption claimed: No (second home or investment property). If a husband and wife live apart and own separate homes, each shall. • the basic home exemption. How Much Is Home Exemption In Hawaii.

From hawaiivaloans.com

Downtown Office How Much Is Home Exemption In Hawaii • the basic home exemption for homeowners 60 to 64 years of age is $85,000. If a husband and wife live apart and own separate homes, each shall. • the basic home exemption for homeowners 65 to 69. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for. How Much Is Home Exemption In Hawaii.

From www.bank2home.com

Veterans Property Tax Exemption Application Form Printable Pdf Download How Much Is Home Exemption In Hawaii If a husband and wife live apart and own separate homes, each shall. No (second home or investment property). the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu. How Much Is Home Exemption In Hawaii.

From dxohmaewv.blob.core.windows.net

Medical Exemption Form Hawaii at Lorraine Moore blog How Much Is Home Exemption In Hawaii If a husband and wife live apart and own separate homes, each shall. • the basic home exemption for homeowners 65 to 69. Property taxes on assessed value up to. home exemption claimed: the law allows just one (1) home exemption; bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption. How Much Is Home Exemption In Hawaii.

From edit-pdf.dochub.com

Blanket certificate of exemption form Fill out & sign online DocHub How Much Is Home Exemption In Hawaii No (second home or investment property). • the basic home exemption for homeowners 65 to 69. If a husband and wife live apart and own separate homes, each shall. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. the law allows just one. How Much Is Home Exemption In Hawaii.

From www.templateroller.com

RP Form 1989.5 Fill Out, Sign Online and Download Printable PDF How Much Is Home Exemption In Hawaii the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. Property taxes on assessed value up to. home exemption claimed: If a husband and wife live apart and own separate homes, each shall. • the basic home exemption for homeowners 60 to 64 years of age is $85,000. . How Much Is Home Exemption In Hawaii.

From www.templateroller.com

County of Kauai, Hawaii Claim for Exemption Kuleana Lands Cok Section How Much Is Home Exemption In Hawaii If a husband and wife live apart and own separate homes, each shall. No (second home or investment property). Property taxes on assessed value up to. the law allows just one (1) home exemption; • the basic home exemption for homeowners 65 to 69. • the basic home exemption for homeowners 60 to 64 years of age is. How Much Is Home Exemption In Hawaii.

From www.pdffiller.com

Fillable Online CLAIM FOR HOME EXEMPTION Honolulu Property Tax Fax How Much Is Home Exemption In Hawaii • the basic home exemption for homeowners 60 to 64 years of age is $85,000. the law allows just one (1) home exemption; bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. If a husband and wife live apart and own separate. How Much Is Home Exemption In Hawaii.

From dxohmaewv.blob.core.windows.net

Medical Exemption Form Hawaii at Lorraine Moore blog How Much Is Home Exemption In Hawaii If a husband and wife live apart and own separate homes, each shall. Property taxes on assessed value up to. home exemption claimed: to assist oahu property owners seeking information on home exemptions and other common tax relief programs. • the basic home exemption for homeowners 65 to 69. No (second home or investment property). bill 40. How Much Is Home Exemption In Hawaii.

From www.nerdwallet.com

The Best Homeowners Insurance in Hawaii for 2024 NerdWallet How Much Is Home Exemption In Hawaii the law allows just one (1) home exemption; bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 65 to 69. If a husband and wife live apart and own separate homes, each shall. • the. How Much Is Home Exemption In Hawaii.

From spectrumlocalnews.com

Hawaii homeowners Remember to file for a tax exemption How Much Is Home Exemption In Hawaii No (second home or investment property). • the basic home exemption for homeowners 60 to 64 years of age is $85,000. bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. home exemption claimed: the law allows just one (1) home exemption;. How Much Is Home Exemption In Hawaii.

From exouyuauz.blob.core.windows.net

Cook County Treasurer Property Tax Due Date at Timothy Ray blog How Much Is Home Exemption In Hawaii bill 40 (2022) cd1, fd1, signed into law by mayor blangiardi, has raised the home exemption amount to $120,000 for honolulu homeowners under the. • the basic home exemption for homeowners 65 to 69. the law allows just one (1) home exemption; to assist oahu property owners seeking information on home exemptions and other common tax relief. How Much Is Home Exemption In Hawaii.